(Article courtesy of MissouriNet.)

The Missouri House of Representatives has passed a proposed $1 billion tax cut plan. The Republican bill would reduce the corporate income tax from 4% to 2% next year.

Beginning in 2025, the rate could drop another 1% if the state meets certain revenue goals. Under the package, the tax could be eliminated altogether by 2027.

Other pieces would reduce the income tax rate and exempt Social Security benefits from being taxed.

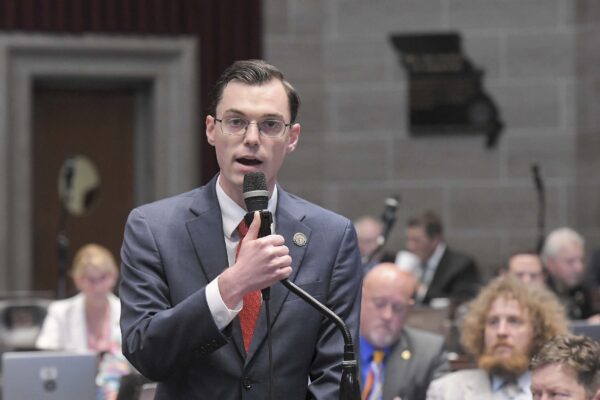

State Rep. Dirk Deaton, R-Noel, is sponsoring the bill.

“The personal income tax included in this legislation leaves more money in the pockets of the people Missouri and cutting taxes on all businesses small and large alike will make Missouri more competitive for the retention and creation of new business investment in our state. Businesses being able to invest more in their workforce leading to higher wages, more jobs,” said Deaton.

State Rep. Michael O’Donnell, R-Oakville, said the Social Security exemption would attract retirees to Missouri.

“Bringing these folks to the state of Missouri with their steady income helps shore up our economy,” O’Donnell.

Last September, the Missouri Legislature passed a tax cut plan that reduced the top income tax rate from 5.3% to 4.95%. If certain revenue conditions are met, the rate will eventually be lowered to 4.5%.

Under Deaton’s bill, the top rate would move to 4.5%, with further cuts eventually taking the rate to 4.05%.

State Rep. Peter Merideth, D-St. Louis, said the legislation would lead to state budget cuts on other items to help seniors and public education.

“This tax cut is bigger than the Brownback tax cuts that failed Kansas,” said Merideth. “Understand it’s the exact same people pushing this. It is the same billionaires pushing this that pushed that.”

House Bill 816 heads to the Missouri Senate for further review.